Lumia: The Next Leader in DeFi Liquidity

The DeFi space is witnessing an exciting transformation with the introduction of Lumia. A pioneering concept in the realm of digital finance, Lumia is set to revolutionize the way we interact with decentralized finance by introducing a seamless liquidity network unlike any other. Let’s delve into what makes Lumia an indispensable innovation in the DeFi landscape.

Orion: The Trailblazer for Retail Users

Orion began as a pioneering platform in the DeFi space, distinguishing itself with an industry-first technology that aggregated liquidity from both centralized exchanges (CEXs) and decentralized exchanges (DEXs). This was a groundbreaking move that allowed retail users to access a wide range of trading options through a single interface known as the Orion Terminal. Key features included:

- Retail-Focused: Orion was designed with the retail user in mind, providing a user-friendly gateway to the world of DeFi.

- Aggregated Liquidity: By pooling resources from various CEXs and DEXs, Orion offers its users unparalleled access to liquidity, enhancing their trading experience.

Lumia: The Next Step in DeFi’s Evolution

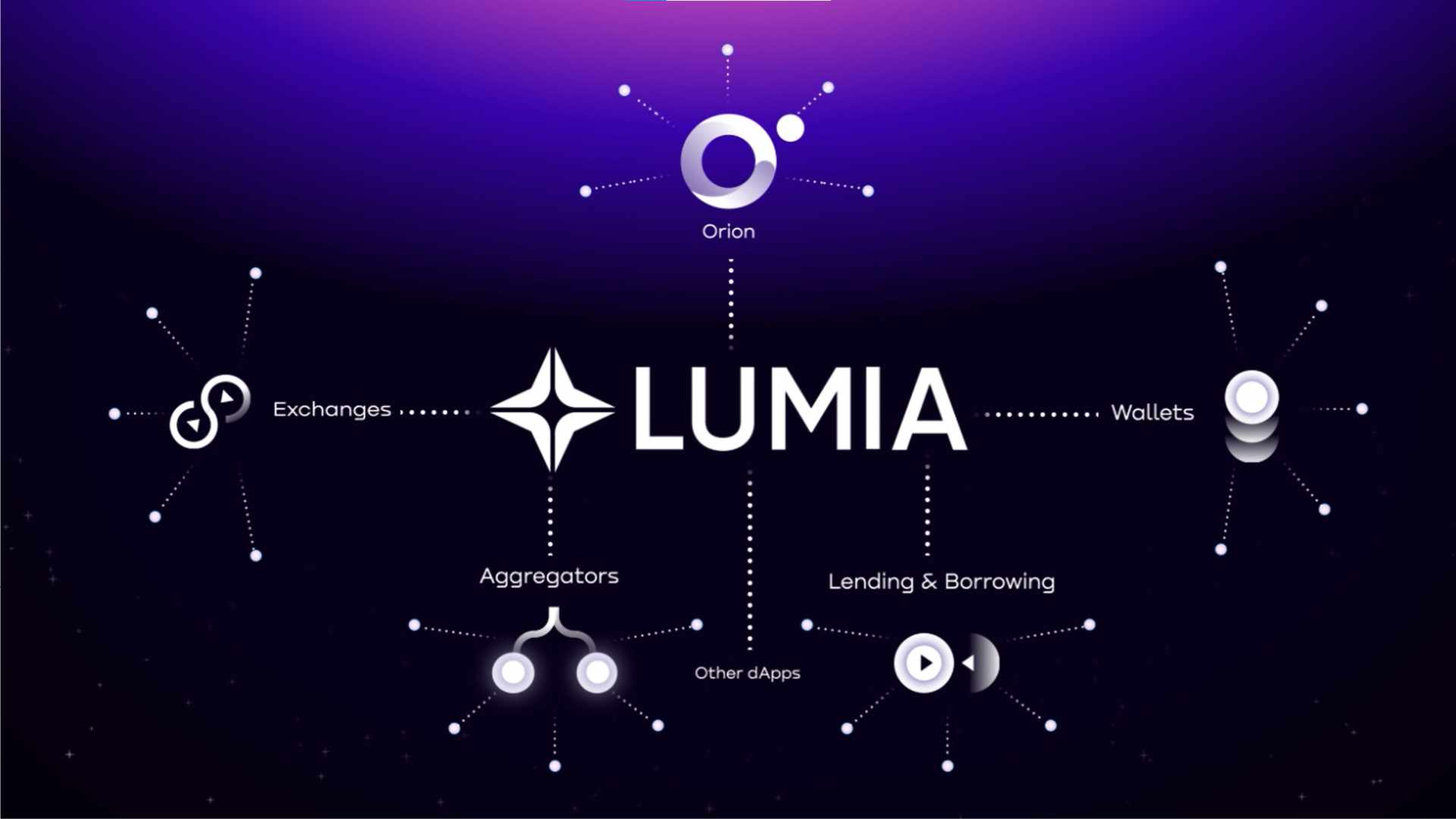

As the ecosystem matured, the need for a more expansive and inclusive platform became apparent. Lumia represents this next step, transcending the foundation built by Orion to power a broader spectrum of DeFi applications. Lumia’s emergence signifies a shift towards a more comprehensive service offering:

- Beyond Retail: While Orion focused on retail users, Lumia extends its services to power web3 wallets, DEXs, other aggregators, and beyond.

- DeCEX Liquidity for All: Lumia democratizes access to deCEX liquidity, allowing various applications to offer this enhanced liquidity to their user bases.

- A Platform for Platforms: Lumia positions itself as a foundational layer upon which other services can build and expand, providing them with the tools and liquidity to thrive.

At its core, Lumia is a decentralized liquidity network designed to bridge the gap between centralized exchanges (CEXs) and decentralized exchanges (DEXs). It is the first to integrate the liquidity of CEXs, a unique feature that sets it apart from existing DeFi liquidity networks. Lumia aspires to create a single, cohesive ecosystem where liquidity is not just sourced but shared across various platforms, thus enhancing the efficiency and reach of DeFi services.

The Symbiotic Relationship

It’s essential to recognize that Lumia doesn’t replace Orion; it builds upon it. Orion serves as the retail arm of Lumia, continuing to provide a familiar and specialized interface for individual traders. In contrast, Lumia operates as the underlying infrastructure, the engine that powers not just Orion but an entire network of services.

The Need for Lumia in Today’s DeFi

The current DeFi ecosystem, while robust, faces a host of challenges that Lumia addresses:

- Fragmented Liquidity: With numerous DEXs operating in silos, liquidity is spread thin across the market, leading to suboptimal trading conditions like high slippage and price disparities.

- New L1s and L2s: Emerging Layer 1 and Layer 2 solutions struggle to attract Total Value Locked (TVL), hindering the creation of efficient markets. Lumia can channel deep liquidity to these nascent chains, catalyzing their growth and market efficiency.

- Inefficiency and High Costs: Relying solely on LPs (Liquidity Providers) can lead to inefficiencies, with high costs to pay LPs making profits hard to achieve (and to share) by even the top DEXs.

- Limited Market Access: The exclusive reliance on DEX liquidity restricts access to the broader market, leaving significant trading opportunities on CEXs untapped. Lumia extends this access to incorporate the vast liquidity present in CEXs.

- MEV Vulnerabilities: Traders are often exposed to risks like Maximal Extractable Value (MEV) and sandwich attacks. Lumia’s off-chain (yet still decentralized) matching engine safeguards against such exploits, ensuring a secure trading environment.

Lumia’s Unique Selling Point: deCEX Liquidity

Lumia’s integration of deCEX liquidity isn’t just a feature; it’s the linchpin of its revolutionary service. Here’s why deCEX liquidity matters:

- Superior Prices: By tapping into the liquidity of CEXs, Lumia can offer more competitive pricing than DEXs alone could provide.

- Ample Liquidity: The inclusion of CEXs means a deeper and more efficent liquidity pool, reducing slippage and improving trade execution.

- Protection from MEV: Lumia’s off-chain order matching between liquidity nodes means trades are not susceptible to MEV or predatory practices like sandwich attacks, thus protecting the end-user’s interests.

How Does the Lumia Liquidity Network Work?

The Lumia network operates on a robust infrastructure where participants, referred to as Lumia Nodes, play a crucial role. Here’s how it works:

- Collateral and Software: Nodes put up assets as collateral and run the Lumia Node Software, ensuring a trusted environment for liquidity provision.

- CEX API Connection: These nodes connect to centralized exchange APIs, which allows them to offer CEX liquidity through the Lumia network.

- Decentralization Vision: Lumia’s vision extends to a future where anyone can become a Lumia Node, democratizing the provision of liquidity and creating an open, inclusive network.

Applications Powered by Lumia

Lumia is not just for individual traders. Its network is equipped to empower a wide range of applications, including:

- Orion Terminal: The first dapp to run Lumia offers a seamless trading experience by aggregating liquidity for optimal trading conditions.

- Web3 Wallets: These wallets can integrate Lumia to provide their users with direct access to deep liquidity pools for better trading options.

- DEXs and Aggregators: By tapping into Lumia’s network, these platforms can enhance their liquidity, offering their users more competitive rates and more options, making financial operations more fluid and reliable.

- Lending & Borrowing Apps: These platforms benefit from Lumia by accessing broader liquidity, enabling more stable rates and enhancing user experiences in loans and savings.

- Other DeFi Platforms – From GameFi ecosystems to Metaverse projects, Lumia can empower a wide array of platforms with essential liquidity, enabling seamless transactions and vibrant digital economies.

Empowering & Rewarding Users and Nodes

One of the most exciting aspects of Lumia is its reward system, which is designed to benefit all participants in the network:

- Liquidity Nodes: These nodes provide the essential service of maintaining and distributing the aggregated liquidity. In return, they receive a portion of the trading fees generated from the liquidity they contribute to the network.

- Governance Stakers: Those who participate in the governance of Lumia by staking their tokens are rewarded for their role in maintaining the integrity and direction of the platform. This ensures that the decision-making power rests with the users, aligning the platform’s growth with the community’s interests.

In Conclusion

Lumia is more than just a platform; it’s a comprehensive ecosystem that brings unparalleled liquidity to the DeFi space. It stands as a testament to the innovative spirit of decentralized finance, offering a future where trading is more accessible, efficient, and equitable. As we prepare for the upcoming DAO vote, we invite all ORN token holders to join us on this journey.

Stay tuned for detailed announcements on the token swap, and join us as we shape the future of DeFi together. With Lumia, we’re not just building a platform; we’re building a legacy.